Regardless of whether you’re a economical advisor, investment issuer, or other fiscal Skilled, take a look at how SDIRAs can become a strong asset to mature your organization and accomplish your Qualified plans.

If you’re hunting for a ‘established and forget’ investing method, an SDIRA in all probability isn’t the right selection. Since you are in overall Regulate more than just about every investment produced, It is really up to you to perform your own private due diligence. Don't forget, SDIRA custodians are usually not fiduciaries and can't make recommendations about investments.

Larger Expenses: SDIRAs frequently include better administrative charges when compared with other IRAs, as selected elements of the administrative system cannot be automated.

And because some SDIRAs which include self-directed regular IRAs are issue to required minimum distributions (RMDs), you’ll really need to strategy in advance to make certain you may have plenty of liquidity to fulfill The foundations established via the IRS.

Being an investor, however, your choices aren't restricted to shares and bonds if you choose to self-immediate your retirement accounts. That’s why an SDIRA can change your portfolio.

Have the liberty to speculate in Practically any sort of asset by using a risk profile that fits your investment tactic; such as assets that have the probable for a higher fee of return.

Moving cash from 1 variety of account to another style of account, including going money from the 401(k) to a standard IRA.

IRAs held at banking institutions and brokerage firms give limited investment possibilities for their clients given that they would not have the expertise or infrastructure to administer alternative assets.

Put merely, in the event you’re searching for a tax efficient way to create a portfolio that’s a lot more tailor-made to your pursuits and know-how, an SDIRA may be the answer.

Array of Investment Selections: Make sure the company makes it possible for Physical asset investment specialists the kinds of alternative investments you’re considering, which include real estate, precious metals, or personal fairness.

Confined Liquidity: Most of the alternative assets that can be held within an SDIRA, which include housing, private fairness, or precious metals, will not be quickly liquidated. This may be a problem if you need to entry resources swiftly.

Bigger investment alternatives usually means it is possible to diversify your portfolio further than stocks, bonds, and mutual funds and hedge your portfolio in opposition to current market fluctuations and volatility.

Lots of traders are stunned to understand that utilizing retirement resources to take a position in alternative assets continues to be attainable given that 1974. On the other hand, most brokerage firms and banking companies center on presenting publicly traded securities, like shares and bonds, given that they lack the infrastructure and knowledge to handle privately held assets, including real-estate or private equity.

Consequently, they tend not to market self-directed IRAs, which provide the flexibleness to invest inside a broader selection of assets.

A self-directed IRA is definitely an extremely strong investment automobile, but it really’s not for everybody. Since the stating goes: with terrific electric power comes good accountability; and with the SDIRA, that couldn’t be more genuine. Keep reading to know why an SDIRA could possibly, or may not, be for you.

Customer Support: Search for a provider which offers committed assist, like entry to educated specialists who will response questions about compliance and IRS rules.

Homework: It is really named "self-directed" for the purpose. Having an SDIRA, you happen to be entirely chargeable for extensively looking into and vetting investments.

Entrust can assist you in getting alternative investments with all your retirement resources, and administer the buying and selling of assets that are generally unavailable by financial institutions and brokerage firms.

Real-estate is one of the preferred possibilities amongst SDIRA holders. That’s since you are able to spend money on any type of housing by using a self-directed IRA.

Jonathan Taylor Thomas Then & Now!

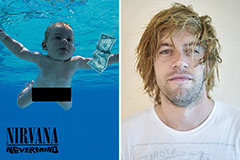

Jonathan Taylor Thomas Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now!